Insolvency as a strategic option for enterprise management

Especially in owner-managed companies, insolvency is still generally seen as a “bugaboo”. As a result, it should be avoided at all costs.1 But are insolvency and strategy actually in contradiction? According to COMPANY PARTNERS, a proactive management of the “enterprise-life-cycle” can resolve this contradiction. This thesis will be presented in the following.

Introduction

The current number of insolvencies in Germany increased in 2021. Due to a lack of assets, especially the number of rejected insolvency applications increased from an average of 28.6% during the last 4 years to 33.1% in 2021 – an indicator that companies “have their backs stand against the wall “. The statistics do not indicate which role strategic management plays in this discourse. The simple consequence for these companies is liquidation.

Enterprise life cycle

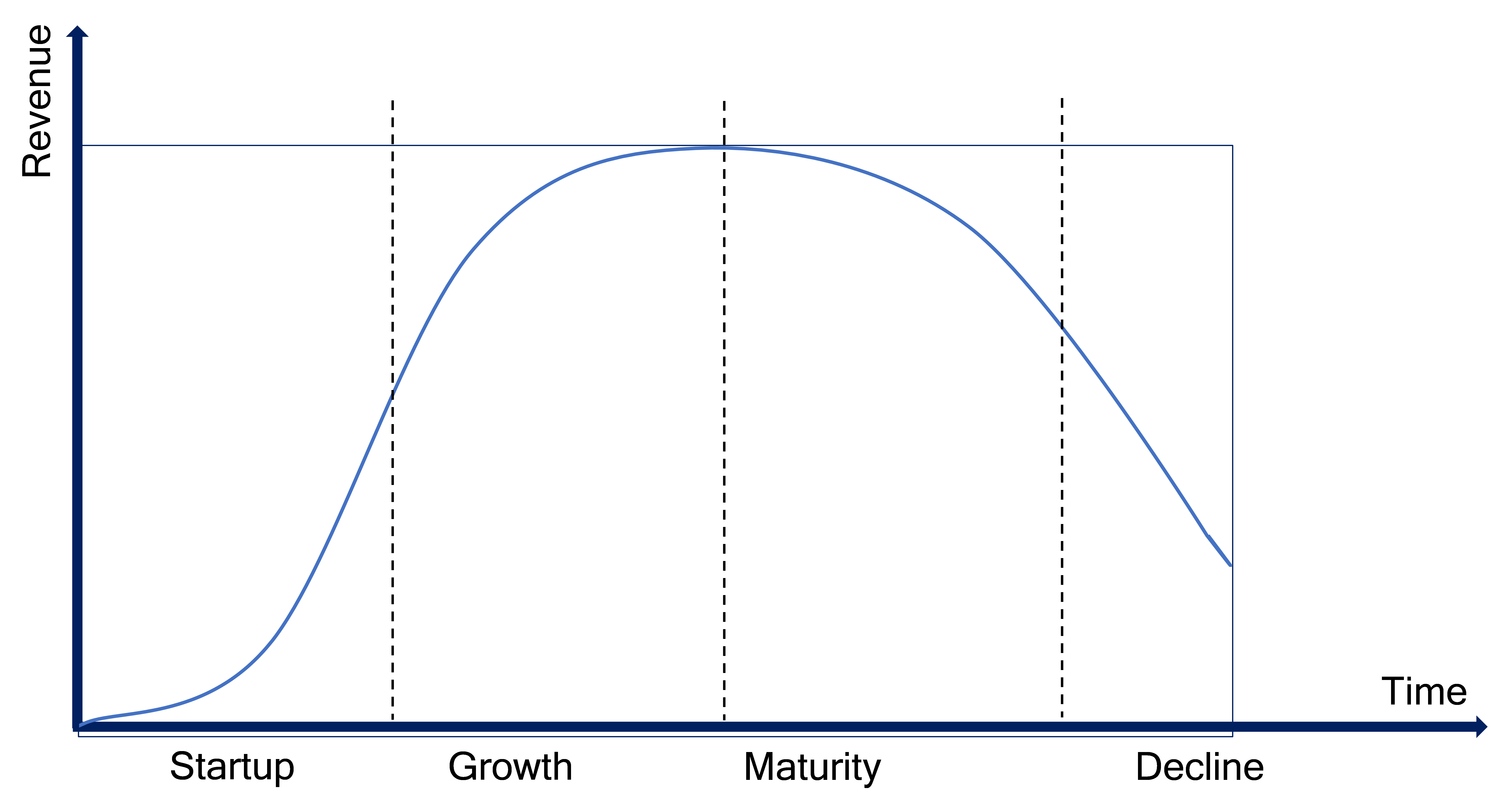

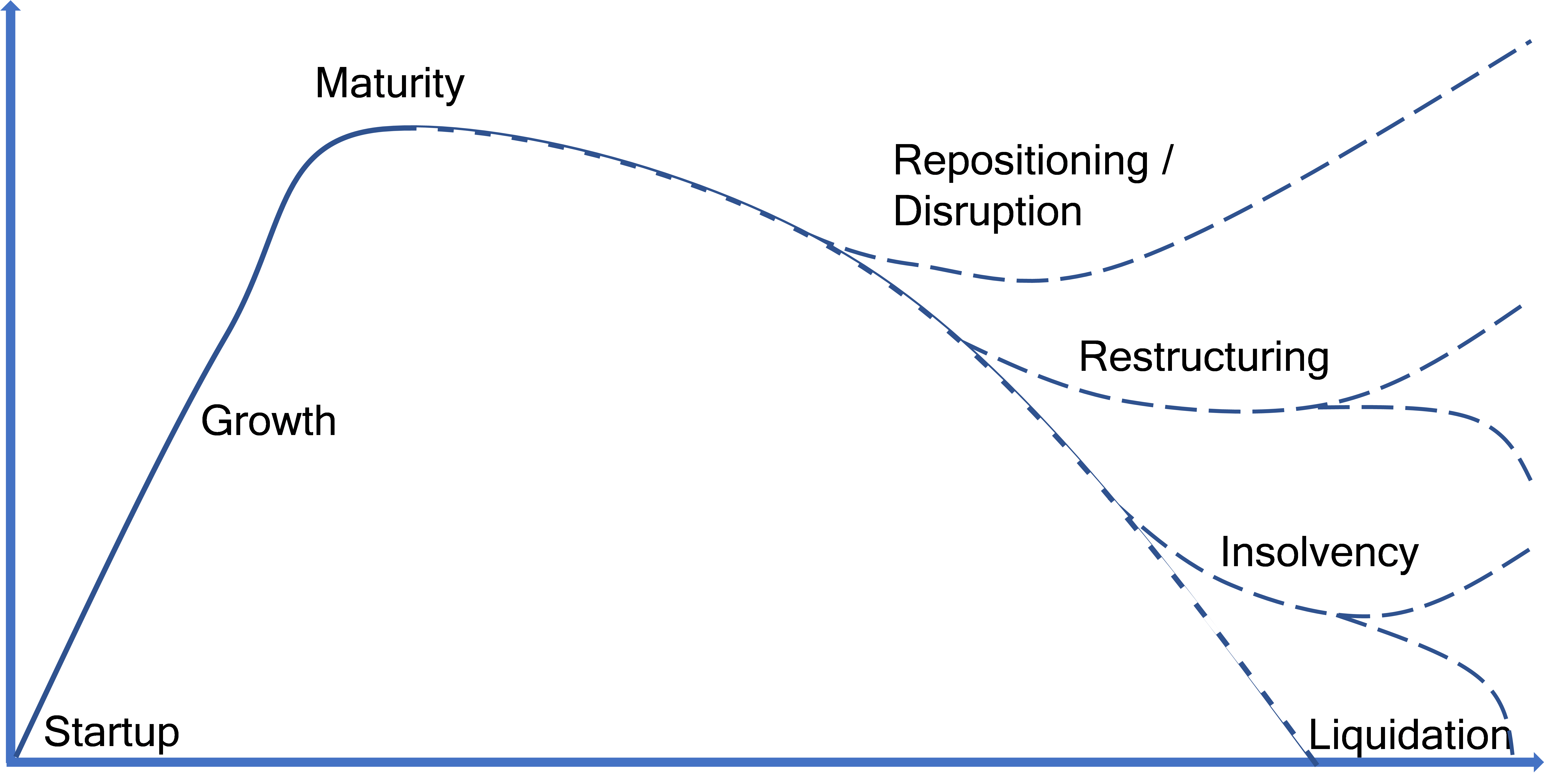

From a factual point of view, the end of a company always requires its start. In essence, the end is just as certain as the beginning. Literature distinguishes between four phases, e.g. according to St.Gallen Business School 2:

It is typical for most life cycle concepts that the phase of degeneration remains open. Theoretically, all life cycle concepts in literature would have to end (at some point) with the liquidation of the company.

In reality, the lifespan of the company from startup to termination depends very much on the ability to proactively adapt to changes in the environment (market, competition, regulation).

Since a company usually defines itself through its products and / or services and their added value for the customer, graphics for the “enterprise life cycle” are based heavily on those that are used to show the “product life cycle”.

The “product-life-cycle” management has found its permanent place in the theory of company management or brand management.

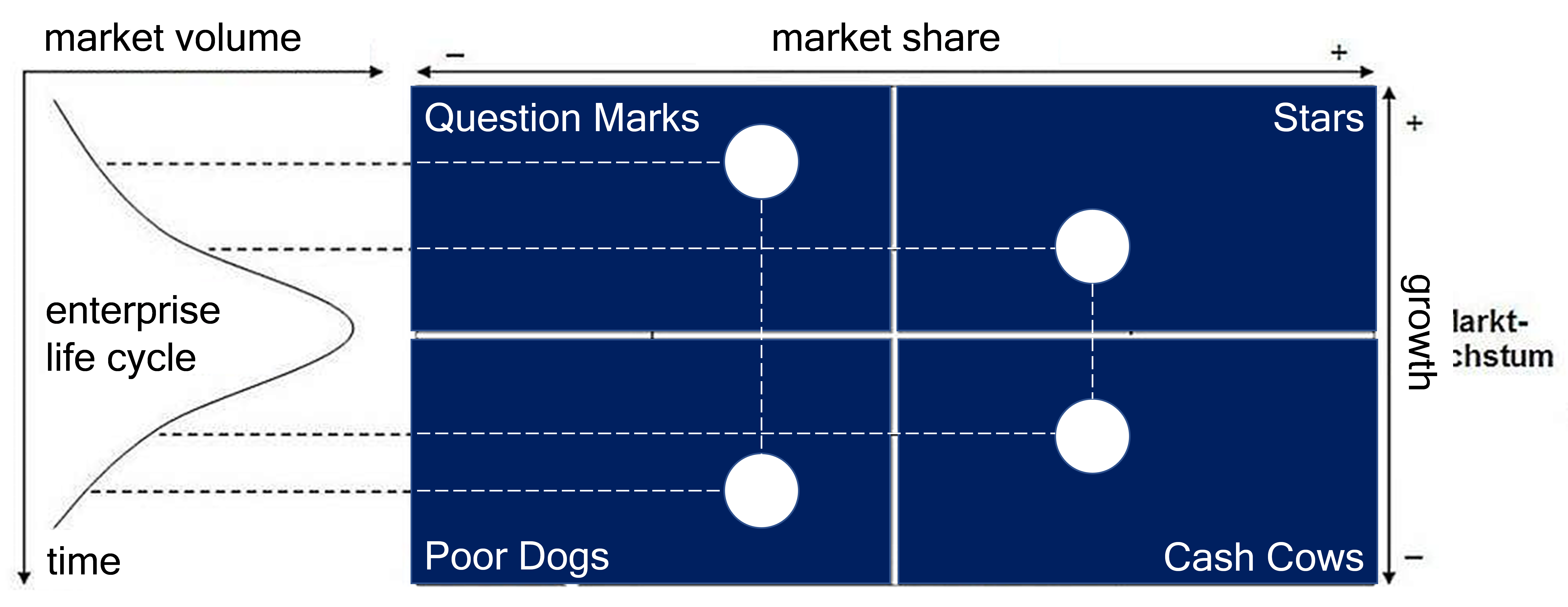

In its well-known “BCG Portfolio Matrix”3, named after the company, Boston Consulting creates a close connection between the product life cycle and the enterprise life cycle:

In the case of a one-product company, the enterprise-life-cycle and product-life-cycle would theoretically be congruent. The situation is similar for companies with other products, providing that the main product is dominant for the company’s success.

As a consequence, one may wonder why companies usually operate a consistent management of product-life-cycles, but not their own enterprise-life-cycle.

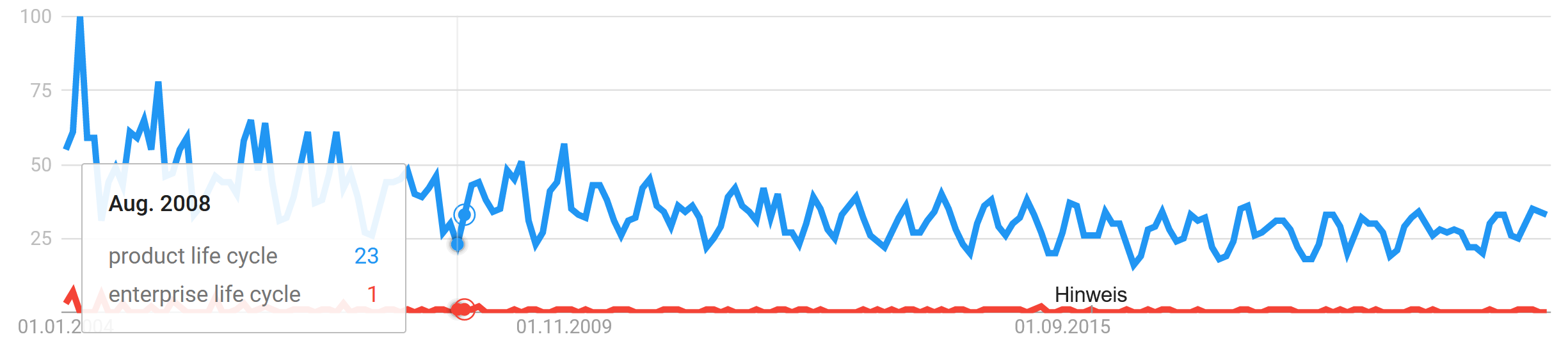

Google trend shows the discrepancy between product-life-cycle and enterprise-life-cycle from 2004 until today:

Even in times of the financial market-driven economic crisis beginning in September 2008, the relative insignificance of the enterprise-life-cycle management remained. The German Google trend search leads to the same results.

The graphic used by the St. Gallen Business School to represent the company-life-cycle does not need an open end in uncertainty.

According to Company Partners, a complete graphic of the enterprise-life-cycle should have the following options:

Successful repositioning in terms of acting like a start-up company can initiate a new phase of growth and promote further developments.

A glaring example of not managing the corporate-life-cycle is the well-known “Kodak case”. The company neglected to switch from negative film to digital photography or to promote its own innovations in good time.

The topic of “disruption” is currently on everyone’s lips. According to a Google trend analysis, the term beats the past search of the linguistically adapted “product-life-cycle” in Germany and even worldwide.

Regardless of the fact that innovative processes and / or technologies can occur in all phases of the company life cycle, Company Partners recommends strategically dealing with at least 2 subsequent phases, depending on the current situation.

- During the startup phase, this means dealing with the growth phase – organic or inorganic – and the maturity / saturation phase at an early stage.

- During the growth phase, the maturity phase up to restructuring should be considered strategically.

- During the maturity phase, all options up to liquidation should be strategically evaluated in any case.

Strategic Enterprise Management

Strategic evaluations require knowledge and a systematic application. “The strategic enterprise management as a pre-control task with regard to the later realization of success consists of search, creation and maintenance of high and secure success potentials, which always includes the timely identification of innovation potentials.”4

The strategic evaluation is based on the analysis of the initial situation. Systematic analysis objects include the life cycle, the market position, the product portfolio and industry-specific opportunities / risks from innovation and disruption.

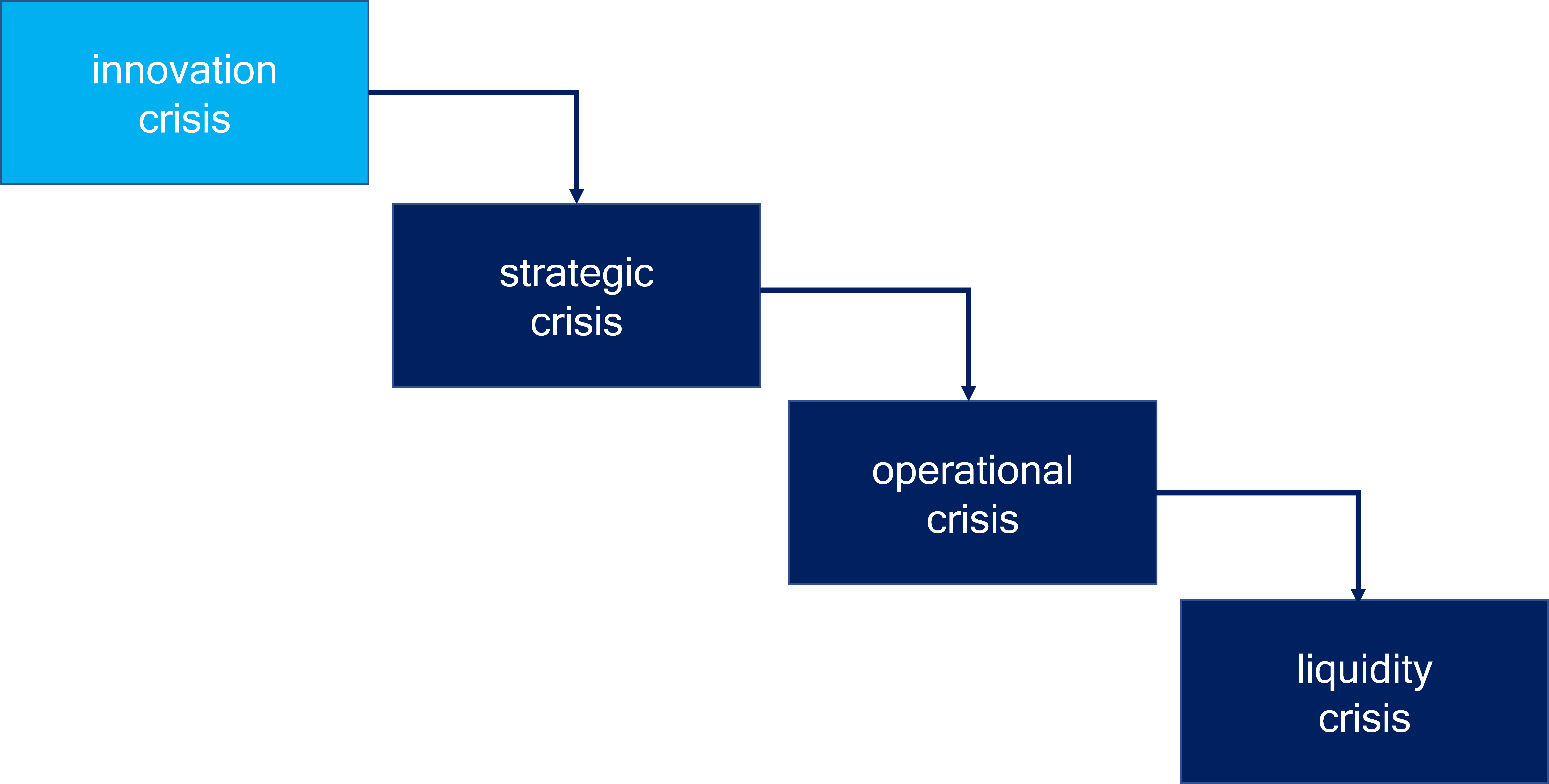

In his book “Strategische Unternehmensführung”4 (engl.: Strategic enterprise management), Aloys Gälweiler interpretes the innovation crisis as a risk trigger for a later liquidity crisis as early as the 1990s.

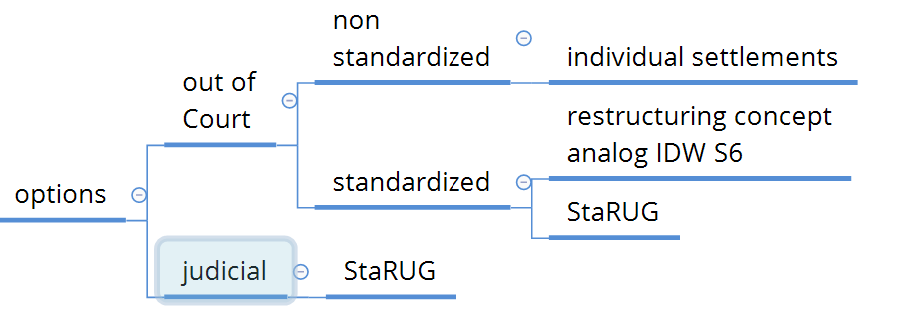

The analysis of the initial situation is followed by the development of strategic options. The knowledge of the options, e.g. of a restructuring, includes

- Out of court solutions

- non standardized, e.g. liquidity measures on the capital market or individual settlements

- standardized such as

- restructuring agreements based on Institut der deutschen Wirtschaftsprüfer IDW S6 or

- settlements in accordance with the StaRUG (law on the stabilization and restructuring framework for companies) that has been in force since January 1, 2021

- court/judicial settlements in accordance with the StaRUG

- insolvency solutions

- „Schutzschirmverfahren“ (engl. “protecive shield procedure”)

- self administration or

- regular bankruptcy

When analysing the options, radical approaches should not be disregarded. The longer a company has been on the market, the more it has to ask itself questions such as:

„How would we start today in order to displace the established competitors in our market?“

Consequently, the assessment or selection of the strategic options takes place, considering their suitability (skills, change management skills, etc.), the acceptance of the stakeholders and feasibility (including in relation to technologies and feasibility with the existing or remaining employees).

The decisive factor for success is the consistent and rapid implementation of the strategic options that have been decided.

Insolvency as strategic Option

Insolvency is one of the basic options during a beginning degeneration. Further options are: pre-insolvency, out-of-court and judicial insolvenies:

This overview is explained in more detail below. Basically, the earlier a company reacts to a crisis, the more self-determined the crisis can be resolved.

For a better understanding, a distinction between two starting positions is made: The emerging liquidity crisis and the acute liquidity crisis.

1. Emerging liquidity crisis

The restructuring goal can be achieved by the company itself.

- Individual, out-of-court settlements can already be negotiated in the context of the operational crisis. Nevertheless, they require the trust of the creditors / stakeholders in the viability of the company, because a reorganization can only be achieved with the consent of all parties involved. This is often no longer the case in the liquidity crisis – including the impending insolvency.

- The StaRUG (in court/judicial, but especially out of court) can replace the lack of trust of individual stakeholders with the majority principle, applicable to the restructuring plan in the event of impending insolvency (impending liquidity crisis).

- The „Schutzschirmverfahren“ (§ 270d InsO) corresponds to a self-administration plus filing an insolvency plan. The plan submission is subject to a deadline (ideally the plan is prepared 6 months beforehand by the company) and the application is only possible in the event of impending insolvency. Even here a lack of trust from individual stakeholders is replaced by the majority principle of the insolvency plan. The potential occurrence of insolvency in the proceedings only leads to the cancellation of self-administration, if the self-administration planning is based on facts that are inaccurate in essential points. This procedure is eligible for insolvency payments, the employment agency is to be involved as a (later) creditor

2. Acute liquidity crisis

The restructuring goal can only be achieved together with other stakeholders.

- Self-administration plus submission of a restructuring plan outside of the protective shield proceedings is possible in the event of bankruptcy and / or over-indebtedness. The submission of a plan is not subject to a deadline; self-administration planning is required. The creation of the restructuring plan during the ongoing proceedings with the involvement of the trustee, the preliminary creditors’ committee and the main creditors is in conflict with the shorter-term “dual-track”, the sales process of the company or its assets. The insolvency plan with structural preservation is often not possible in the short term, so the often short-term possible sale in form of an “asset deal” is often preferred by the creditors

This self-administration approach is eligible for insolvency payments; the employment agency must also be included as the later creditor in the context of drawing up the plan.

- The standard/regular insolvency procedure is possible in the event of bankruptcy and / or over-indebtedness, providing that sufficient funds are still available. She is eligible for insolvency payments. The company is preferably sold by way of an asset deal. However, an insolvency plan is possible and must be coordinated with the initially provisional insolvency administrator. The disadvantage of the insolvency plan is the longer and uncertain period – while the short-term realization of the assets offers the creditors more security.Regular insolvency also serves to wind up companies that are not viable. German corporations affected in this way have the addition “i.L.” = “in liquidation” as part of their company title from this phase.

Advantages of Insolvency

Compared to the pre-insolvency options of restructuring with or without StaRUG, insolvency offers some advantages. Here are two examples, regardless of whether a protective shield procedure, self-administration or regular insolvency is being carried out:

- The preliminary insolvency proceedings begin with the application. This means that a payment freeze occurs initially, which gives the company a break and liquidity. This also includes a stop of foreclosure measures.

- It is also crucial in Germany that the employees are entitled to insolvency money for a period of up to three months, which provides the company with additional liquidity. The employees receive their full wages through the employment agency and can contribute to maintaining the company. Although this money is only paid out after the proceedings have been opened, it is pre-financed by specialized banks between filing for insolvency and the opening of the proceedings.

The second advantage in particular favours companies with a high rate of personnel costs such as call centres, contract manufacturers or temporary personnel service providers.

The disadvantages of insolvency are widely known, differ in the type of procedure and should be carefully assessed. Basically, an insolvency plan should be prepared beforehand.

The creation of an insolvency plan pursues the purpose with the tools of the insolvency in order to

- end the insolvency proceedings early

- bring about the release from liabilities and

- significantly shorten the duration of the proceedings – if the creditors and the debtor are in a better position

Recommendation

The situation of every company should be reassessed by the stakeholders and the management at least annually. This includes determining the position of the company life cycle. One lesson from the covid-19-pandemic is that insolvency can occur faster than ever thought. The legislator significantly expanded the regulatory framework for redevelopment on January 1, 2021 with the StaRUG. Further solutions may follow. Dealing with bankruptcy is a natural option – the fear of it is not a good advisor.

Company Partners therefore recommends that companies deal with all strategic options up to liquidation within the framework of the company life cycle management at the latest in the beginning of the saturation phase. The higher the degrees of freedom and self-determined possible solutions!

About Company Partners

Company Partners is a group of consultants, focused on the topics of strategy and restructuring in pre-insolvency phasis. Elsflether Werft AG with sailing vessel “Gorch-Fock” is one of its references in the context of self-administrating insolvency.

About the Author

Matthias Richter, born in 1956, is restructuring companies since 22 years. Part of the success is the interim management of companies out of the crisis – 8 times as CRO Chief Restructuring Officer. The author began his career at IBM and focuses on innovation and sales as key success factors in the operational restructuring. His motto in life: “Life is what happens while you are busy making other plans.” – John Lennon.

Sources

1 Insolvenzstudie, ISBN 978-3-942648-16-5, 2016 Heidelberger Hochschulverlag

2 SGBS Das Lebenszyklus-Modell und die Erfahrungskurve

3 Boston Consulting Group

4 Aloys Gälweiler, 1987